15Ca Form Online - Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. Declaration under section 197a(1) and section 197a(1a) to be made by an. You can submit form 15ca through both online and offline channels.

Declaration under section 197a(1) and section 197a(1a) to be made by an. You can submit form 15ca through both online and offline channels. Form 15ca is available to all persons requiring to file declaration form of the foreign remittance.

Declaration under section 197a(1) and section 197a(1a) to be made by an. Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. You can submit form 15ca through both online and offline channels.

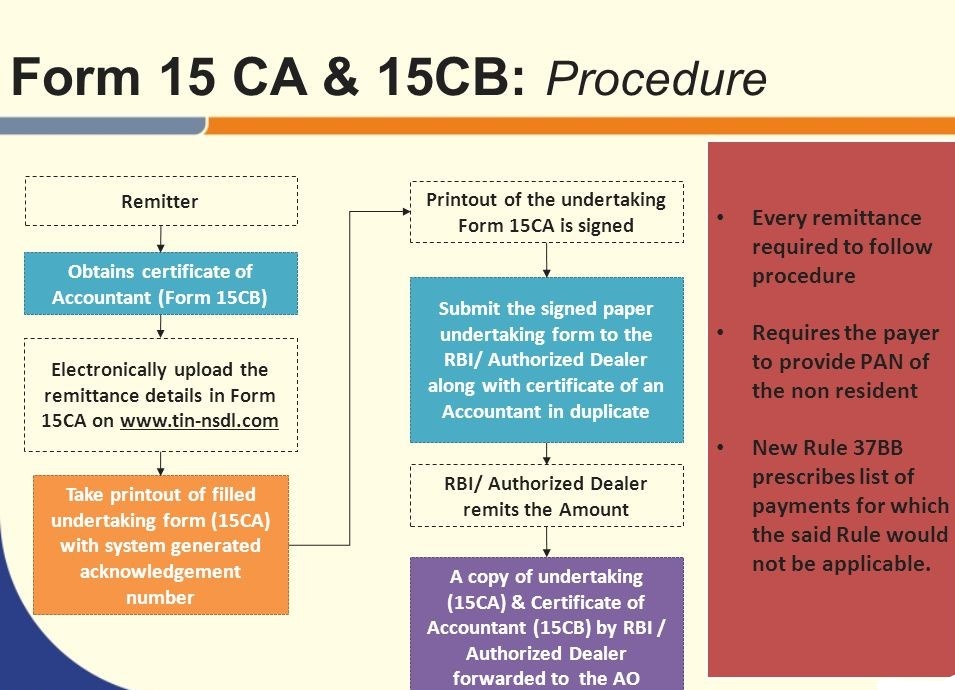

Form 15CA and 15CB of Tax, Online Filling, New Rules 2022

Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. Declaration under section 197a(1) and section 197a(1a) to be made by an. You can submit form 15ca through both online and offline channels.

Further relaxation in Online filing of Form 15CA/CB KNM India

Declaration under section 197a(1) and section 197a(1a) to be made by an. You can submit form 15ca through both online and offline channels. Form 15ca is available to all persons requiring to file declaration form of the foreign remittance.

Form 15CA Filed Form Download Free PDF Tax Taxes

Declaration under section 197a(1) and section 197a(1a) to be made by an. Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. You can submit form 15ca through both online and offline channels.

All About Form 15CA and Form 15CB Setupfilings

Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. You can submit form 15ca through both online and offline channels. Declaration under section 197a(1) and section 197a(1a) to be made by an.

Complete Understanding about Form 15CA, Form 15CB RJA

Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. Declaration under section 197a(1) and section 197a(1a) to be made by an. You can submit form 15ca through both online and offline channels.

All About Form 15CA Form 15CB Taxation Public Finance

You can submit form 15ca through both online and offline channels. Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. Declaration under section 197a(1) and section 197a(1a) to be made by an.

Form 15ca Format Remittance Tax Deduction

You can submit form 15ca through both online and offline channels. Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. Declaration under section 197a(1) and section 197a(1a) to be made by an.

Form 15CA and 15CB of Tax, Online Filling, New Rules 2022

Declaration under section 197a(1) and section 197a(1a) to be made by an. Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. You can submit form 15ca through both online and offline channels.

Apply Online to File form 15CA of Tax

Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. Declaration under section 197a(1) and section 197a(1a) to be made by an. You can submit form 15ca through both online and offline channels.

Declaration Under Section 197A(1) And Section 197A(1A) To Be Made By An.

Form 15ca is available to all persons requiring to file declaration form of the foreign remittance. You can submit form 15ca through both online and offline channels.