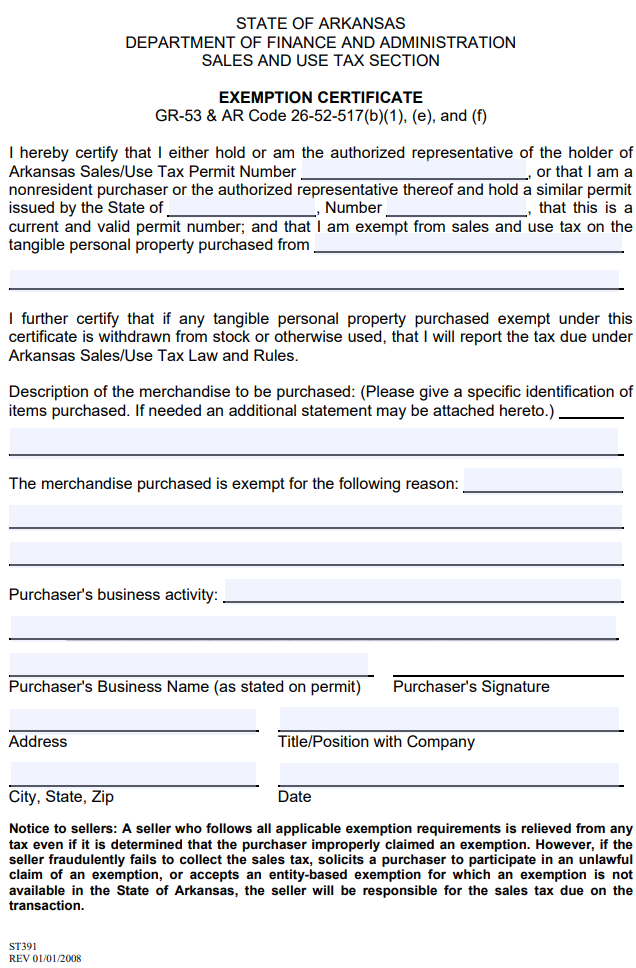

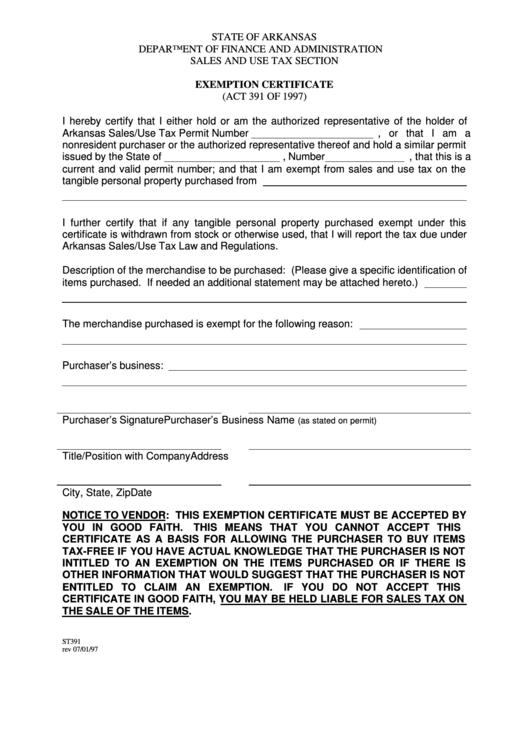

Arkansas Sales Tax Exempt Form - Arkansas sales/use tax law and regulations. The merchandise purchased is exempt for the following reason: Provide the id number to claim exemption from sales tax that is required by the taxing state. Description of the merchandise to be. The arkansas sales and use tax section does not send blank arkansas excise.

Description of the merchandise to be. Provide the id number to claim exemption from sales tax that is required by the taxing state. The arkansas sales and use tax section does not send blank arkansas excise. The merchandise purchased is exempt for the following reason: Arkansas sales/use tax law and regulations.

Description of the merchandise to be. The arkansas sales and use tax section does not send blank arkansas excise. The merchandise purchased is exempt for the following reason: Arkansas sales/use tax law and regulations. Provide the id number to claim exemption from sales tax that is required by the taxing state.

What is Exempt from Sales Tax in Arkansas A Comprehensive Guide

Arkansas sales/use tax law and regulations. Provide the id number to claim exemption from sales tax that is required by the taxing state. The arkansas sales and use tax section does not send blank arkansas excise. The merchandise purchased is exempt for the following reason: Description of the merchandise to be.

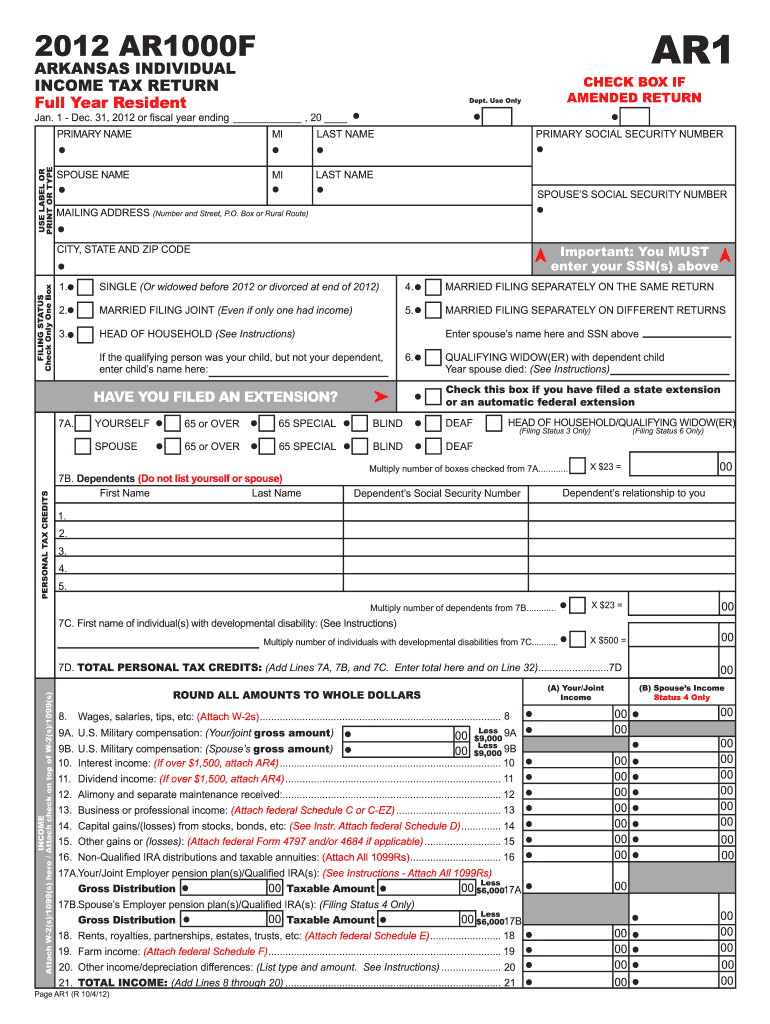

2012 arkansas form tax Fill out & sign online DocHub

The arkansas sales and use tax section does not send blank arkansas excise. Description of the merchandise to be. The merchandise purchased is exempt for the following reason: Provide the id number to claim exemption from sales tax that is required by the taxing state. Arkansas sales/use tax law and regulations.

Ultimate Arkansas Sales Tax Guide Zamp

Provide the id number to claim exemption from sales tax that is required by the taxing state. The arkansas sales and use tax section does not send blank arkansas excise. Arkansas sales/use tax law and regulations. The merchandise purchased is exempt for the following reason: Description of the merchandise to be.

Arkansas Farm Sales Tax Exemption Form

Description of the merchandise to be. Arkansas sales/use tax law and regulations. The arkansas sales and use tax section does not send blank arkansas excise. The merchandise purchased is exempt for the following reason: Provide the id number to claim exemption from sales tax that is required by the taxing state.

How To Get A Sales Tax Exemption Certificate In Colorado

The arkansas sales and use tax section does not send blank arkansas excise. Provide the id number to claim exemption from sales tax that is required by the taxing state. The merchandise purchased is exempt for the following reason: Arkansas sales/use tax law and regulations. Description of the merchandise to be.

Arkansas Withholding Form 2023 Printable Forms Free Online

Description of the merchandise to be. Arkansas sales/use tax law and regulations. The merchandise purchased is exempt for the following reason: Provide the id number to claim exemption from sales tax that is required by the taxing state. The arkansas sales and use tax section does not send blank arkansas excise.

Arkansas Sales Tax Exempt Form

Arkansas sales/use tax law and regulations. The arkansas sales and use tax section does not send blank arkansas excise. The merchandise purchased is exempt for the following reason: Description of the merchandise to be. Provide the id number to claim exemption from sales tax that is required by the taxing state.

Arkansas State Tax Exemption Form

Arkansas sales/use tax law and regulations. The merchandise purchased is exempt for the following reason: Description of the merchandise to be. Provide the id number to claim exemption from sales tax that is required by the taxing state. The arkansas sales and use tax section does not send blank arkansas excise.

Sales Tax Exemption Form For Arkansas Pdf

Provide the id number to claim exemption from sales tax that is required by the taxing state. Description of the merchandise to be. Arkansas sales/use tax law and regulations. The arkansas sales and use tax section does not send blank arkansas excise. The merchandise purchased is exempt for the following reason:

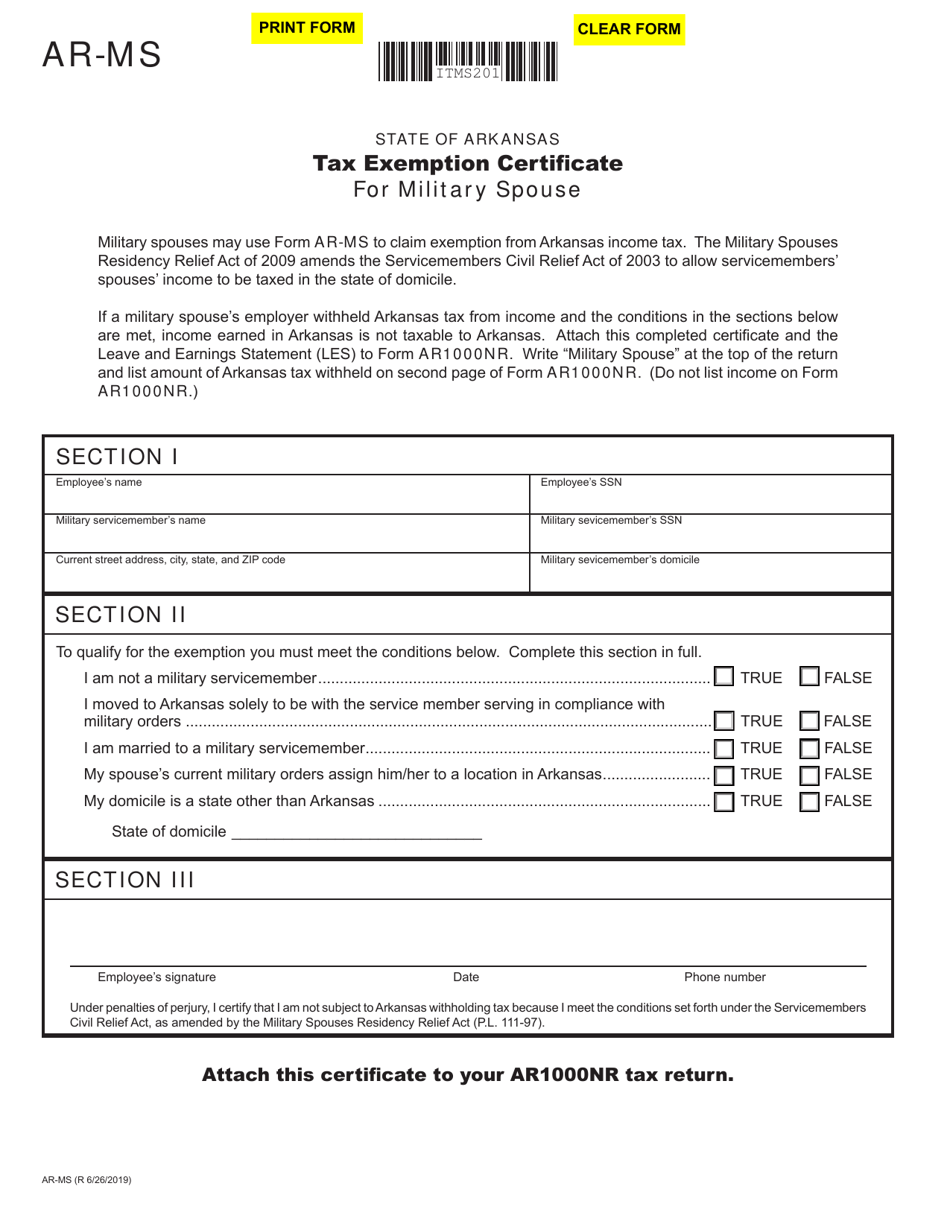

Form ARMS Download Fillable PDF or Fill Online Tax Exemption

Arkansas sales/use tax law and regulations. Description of the merchandise to be. The arkansas sales and use tax section does not send blank arkansas excise. The merchandise purchased is exempt for the following reason: Provide the id number to claim exemption from sales tax that is required by the taxing state.

The Arkansas Sales And Use Tax Section Does Not Send Blank Arkansas Excise.

The merchandise purchased is exempt for the following reason: Provide the id number to claim exemption from sales tax that is required by the taxing state. Arkansas sales/use tax law and regulations. Description of the merchandise to be.