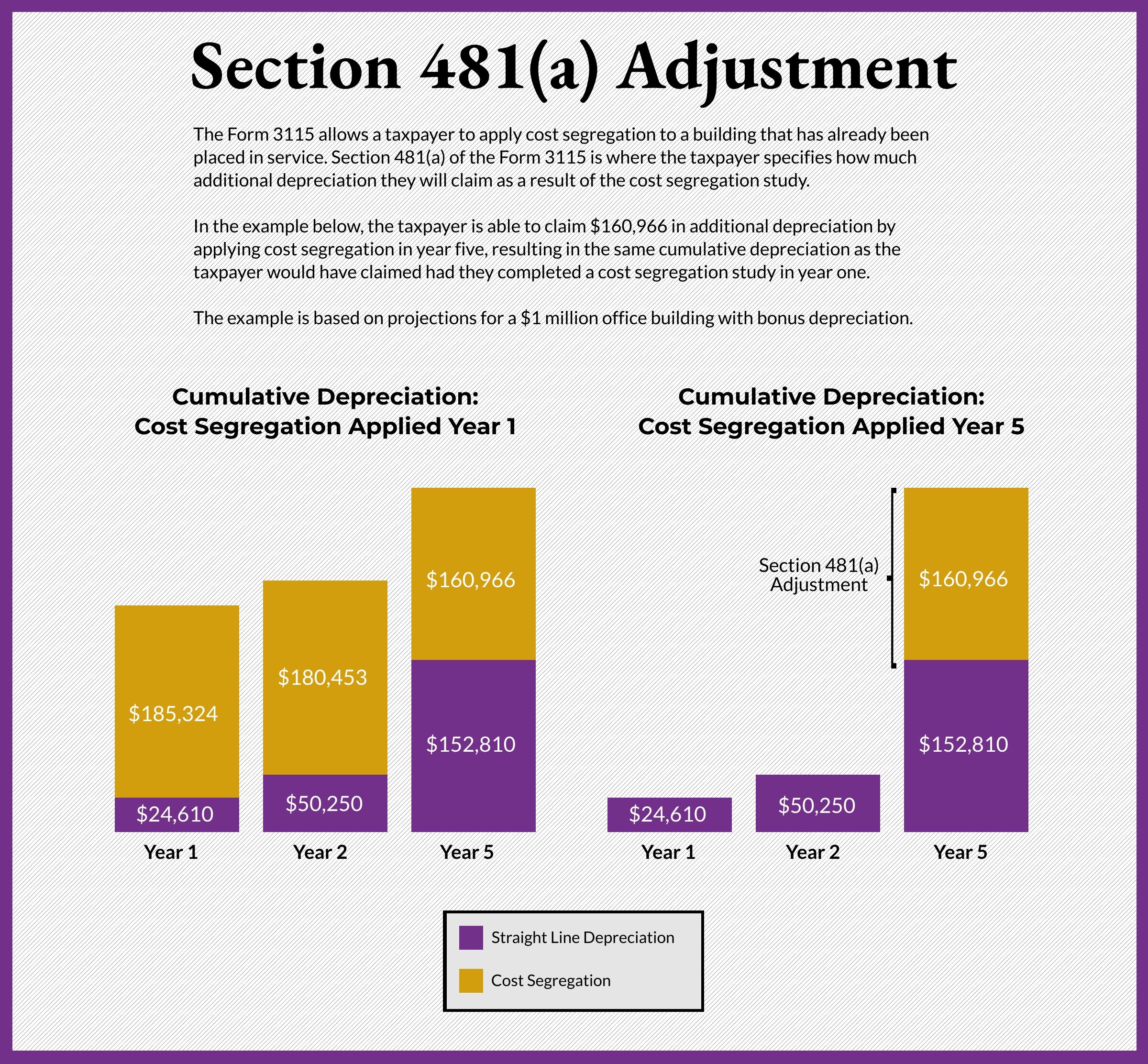

Completed Form 3115 Example - What is irs form 3115? The form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible. Also known as application for change in accounting method,. Detailed and complete description of the facts that explains how the law specifically applies to the applicant’s situation and that demonstrates. Below is an example of the completed irs form 6765.

The form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible. Also known as application for change in accounting method,. Below is an example of the completed irs form 6765. Detailed and complete description of the facts that explains how the law specifically applies to the applicant’s situation and that demonstrates. What is irs form 3115?

Also known as application for change in accounting method,. What is irs form 3115? Detailed and complete description of the facts that explains how the law specifically applies to the applicant’s situation and that demonstrates. Below is an example of the completed irs form 6765. The form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible.

Fillable Form 3115 Printable Forms Free Online

What is irs form 3115? The form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible. Detailed and complete description of the facts that explains how the law specifically applies to the applicant’s situation and that demonstrates. Also known as application for change in accounting method,. Below is an example.

Form 3115 Edit, Fill, Sign Online Handypdf

The form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible. Detailed and complete description of the facts that explains how the law specifically applies to the applicant’s situation and that demonstrates. What is irs form 3115? Below is an example of the completed irs form 6765. Also known as.

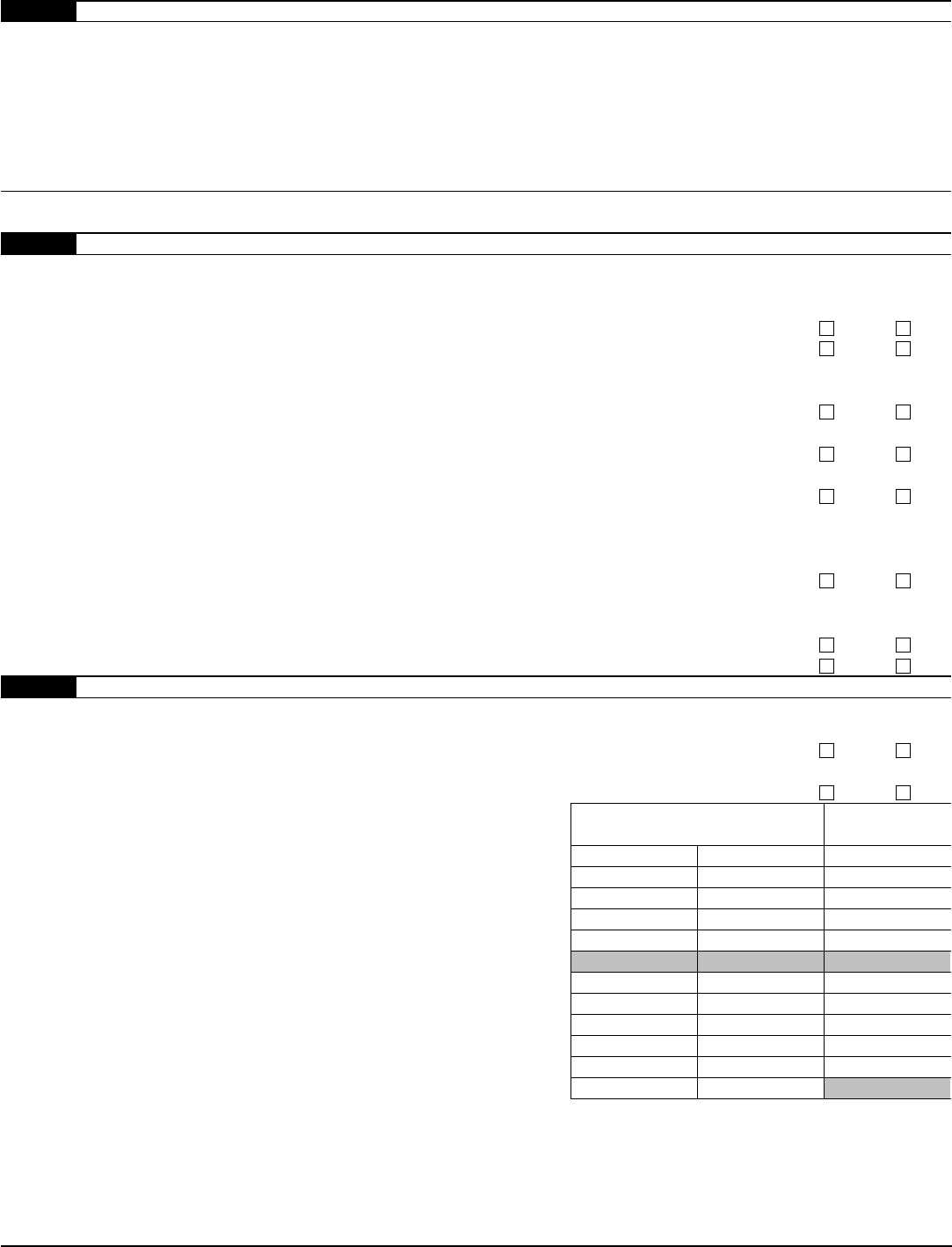

IRS Form 3115 How to Apply Cost Segregation to Existing Property

Detailed and complete description of the facts that explains how the law specifically applies to the applicant’s situation and that demonstrates. The form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible. Below is an example of the completed irs form 6765. Also known as application for change in accounting.

Form 3115

What is irs form 3115? Below is an example of the completed irs form 6765. Detailed and complete description of the facts that explains how the law specifically applies to the applicant’s situation and that demonstrates. The form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible. Also known as.

Form 3115 Definition, Who Must File, & More

Below is an example of the completed irs form 6765. Also known as application for change in accounting method,. Detailed and complete description of the facts that explains how the law specifically applies to the applicant’s situation and that demonstrates. What is irs form 3115? The form 3115 instructions provide that the automatic change number is “7” for changes from.

Fillable Form 3115 Printable Forms Free Online

What is irs form 3115? Also known as application for change in accounting method,. Detailed and complete description of the facts that explains how the law specifically applies to the applicant’s situation and that demonstrates. Below is an example of the completed irs form 6765. The form 3115 instructions provide that the automatic change number is “7” for changes from.

Form 3115 Instructions (Application for Change in Accounting Method)

Also known as application for change in accounting method,. The form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible. Detailed and complete description of the facts that explains how the law specifically applies to the applicant’s situation and that demonstrates. What is irs form 3115? Below is an example.

Form 3115 Source Advisors

Below is an example of the completed irs form 6765. Also known as application for change in accounting method,. Detailed and complete description of the facts that explains how the law specifically applies to the applicant’s situation and that demonstrates. The form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a.

Form 3115 Edit, Fill, Sign Online Handypdf

Also known as application for change in accounting method,. The form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible. What is irs form 3115? Below is an example of the completed irs form 6765. Detailed and complete description of the facts that explains how the law specifically applies to.

Form 3115 Instructions (Application for Change in Accounting Method)

The form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible. Detailed and complete description of the facts that explains how the law specifically applies to the applicant’s situation and that demonstrates. Also known as application for change in accounting method,. What is irs form 3115? Below is an example.

Below Is An Example Of The Completed Irs Form 6765.

Detailed and complete description of the facts that explains how the law specifically applies to the applicant’s situation and that demonstrates. What is irs form 3115? The form 3115 instructions provide that the automatic change number is “7” for changes from an impermissible method to a permissible. Also known as application for change in accounting method,.