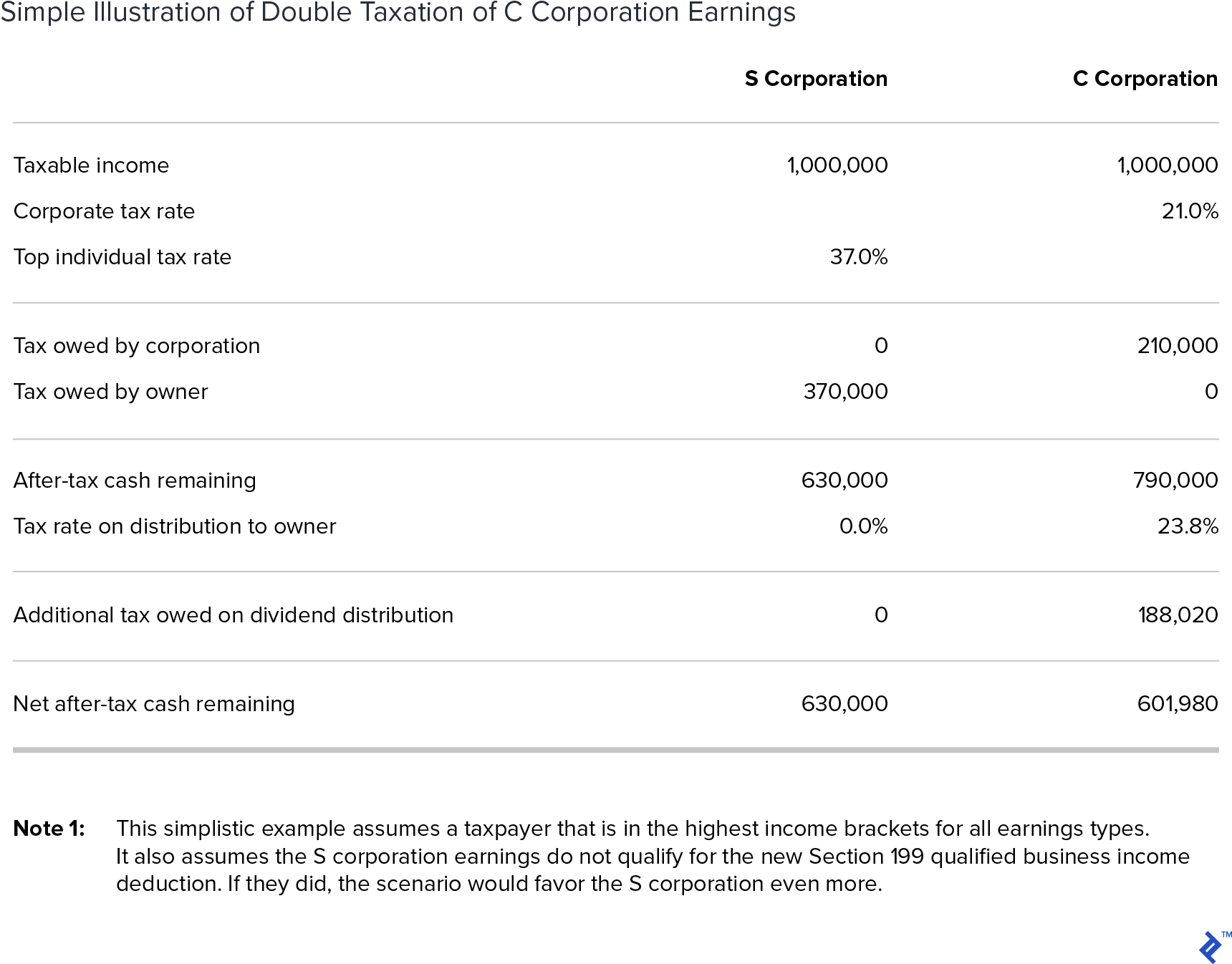

Converting C Corp To S Corp - S corporations that were converted from a c corporation are subject to a special tax if the passive investment income exceeds 25 percent. Learn the tax implications of converting a c corporation to an s corporation, such as the concept of c corporation earnings. Although s corporations can provide significant tax advantages over c corporations in the right circumstances, there are a number of.

S corporations that were converted from a c corporation are subject to a special tax if the passive investment income exceeds 25 percent. Although s corporations can provide significant tax advantages over c corporations in the right circumstances, there are a number of. Learn the tax implications of converting a c corporation to an s corporation, such as the concept of c corporation earnings.

Although s corporations can provide significant tax advantages over c corporations in the right circumstances, there are a number of. S corporations that were converted from a c corporation are subject to a special tax if the passive investment income exceeds 25 percent. Learn the tax implications of converting a c corporation to an s corporation, such as the concept of c corporation earnings.

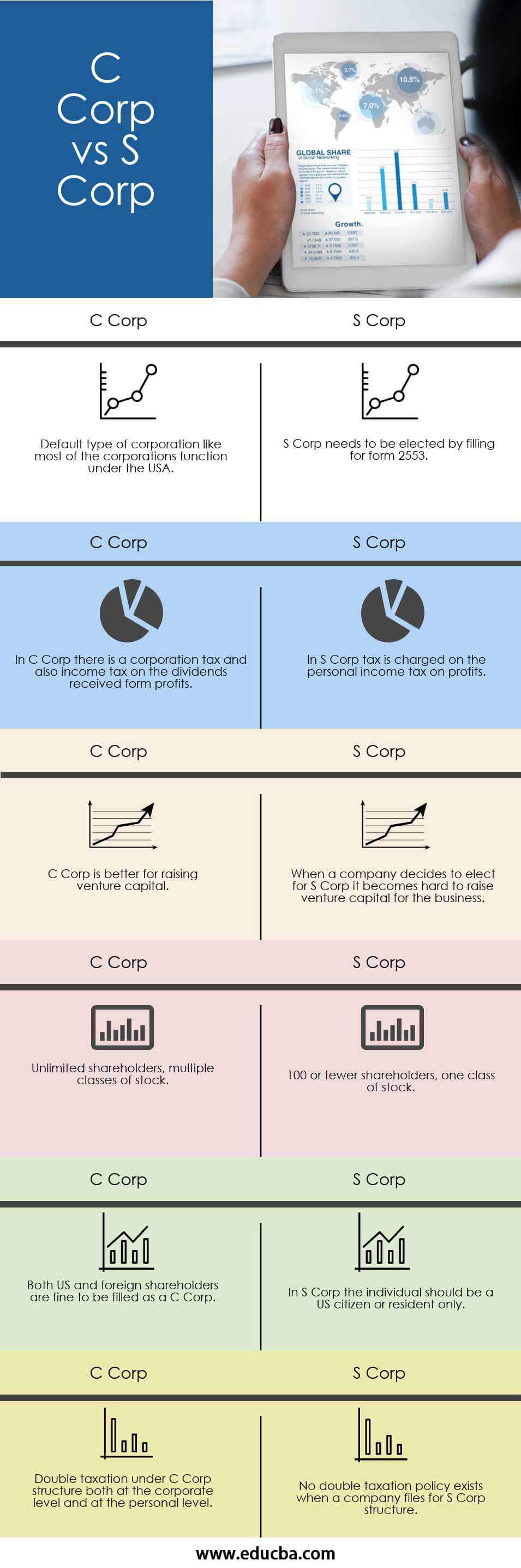

C Corp vs S Corp Differences, Benefits, & Comparison Table Mailchimp

Although s corporations can provide significant tax advantages over c corporations in the right circumstances, there are a number of. Learn the tax implications of converting a c corporation to an s corporation, such as the concept of c corporation earnings. S corporations that were converted from a c corporation are subject to a special tax if the passive investment.

Pin on C Corp vs S Corp

S corporations that were converted from a c corporation are subject to a special tax if the passive investment income exceeds 25 percent. Although s corporations can provide significant tax advantages over c corporations in the right circumstances, there are a number of. Learn the tax implications of converting a c corporation to an s corporation, such as the concept.

c corp and s corp, 7 Differences Between

Learn the tax implications of converting a c corporation to an s corporation, such as the concept of c corporation earnings. S corporations that were converted from a c corporation are subject to a special tax if the passive investment income exceeds 25 percent. Although s corporations can provide significant tax advantages over c corporations in the right circumstances, there.

C Corp vs. S Corp, Partnership, Proprietorship, and LLC Toptal®

Although s corporations can provide significant tax advantages over c corporations in the right circumstances, there are a number of. Learn the tax implications of converting a c corporation to an s corporation, such as the concept of c corporation earnings. S corporations that were converted from a c corporation are subject to a special tax if the passive investment.

Starting a Business Part 4 C Corp vs S Corp Temple Management

Although s corporations can provide significant tax advantages over c corporations in the right circumstances, there are a number of. S corporations that were converted from a c corporation are subject to a special tax if the passive investment income exceeds 25 percent. Learn the tax implications of converting a c corporation to an s corporation, such as the concept.

C Corp vs. S Corp, Partnership, Proprietorship, and LLC Toptal®

Although s corporations can provide significant tax advantages over c corporations in the right circumstances, there are a number of. Learn the tax implications of converting a c corporation to an s corporation, such as the concept of c corporation earnings. S corporations that were converted from a c corporation are subject to a special tax if the passive investment.

Difference Between C Corp and S Corp

Learn the tax implications of converting a c corporation to an s corporation, such as the concept of c corporation earnings. Although s corporations can provide significant tax advantages over c corporations in the right circumstances, there are a number of. S corporations that were converted from a c corporation are subject to a special tax if the passive investment.

C Corp vs S Corp Top 6 Best Differences (With Infographics)

Although s corporations can provide significant tax advantages over c corporations in the right circumstances, there are a number of. S corporations that were converted from a c corporation are subject to a special tax if the passive investment income exceeds 25 percent. Learn the tax implications of converting a c corporation to an s corporation, such as the concept.

Delaware C Corp and S Corp How to determine? HazelNews

S corporations that were converted from a c corporation are subject to a special tax if the passive investment income exceeds 25 percent. Although s corporations can provide significant tax advantages over c corporations in the right circumstances, there are a number of. Learn the tax implications of converting a c corporation to an s corporation, such as the concept.

Difference Between C Corp and S Corp Anthony J. Madonia & Associates, Ltd

S corporations that were converted from a c corporation are subject to a special tax if the passive investment income exceeds 25 percent. Learn the tax implications of converting a c corporation to an s corporation, such as the concept of c corporation earnings. Although s corporations can provide significant tax advantages over c corporations in the right circumstances, there.

Although S Corporations Can Provide Significant Tax Advantages Over C Corporations In The Right Circumstances, There Are A Number Of.

Learn the tax implications of converting a c corporation to an s corporation, such as the concept of c corporation earnings. S corporations that were converted from a c corporation are subject to a special tax if the passive investment income exceeds 25 percent.