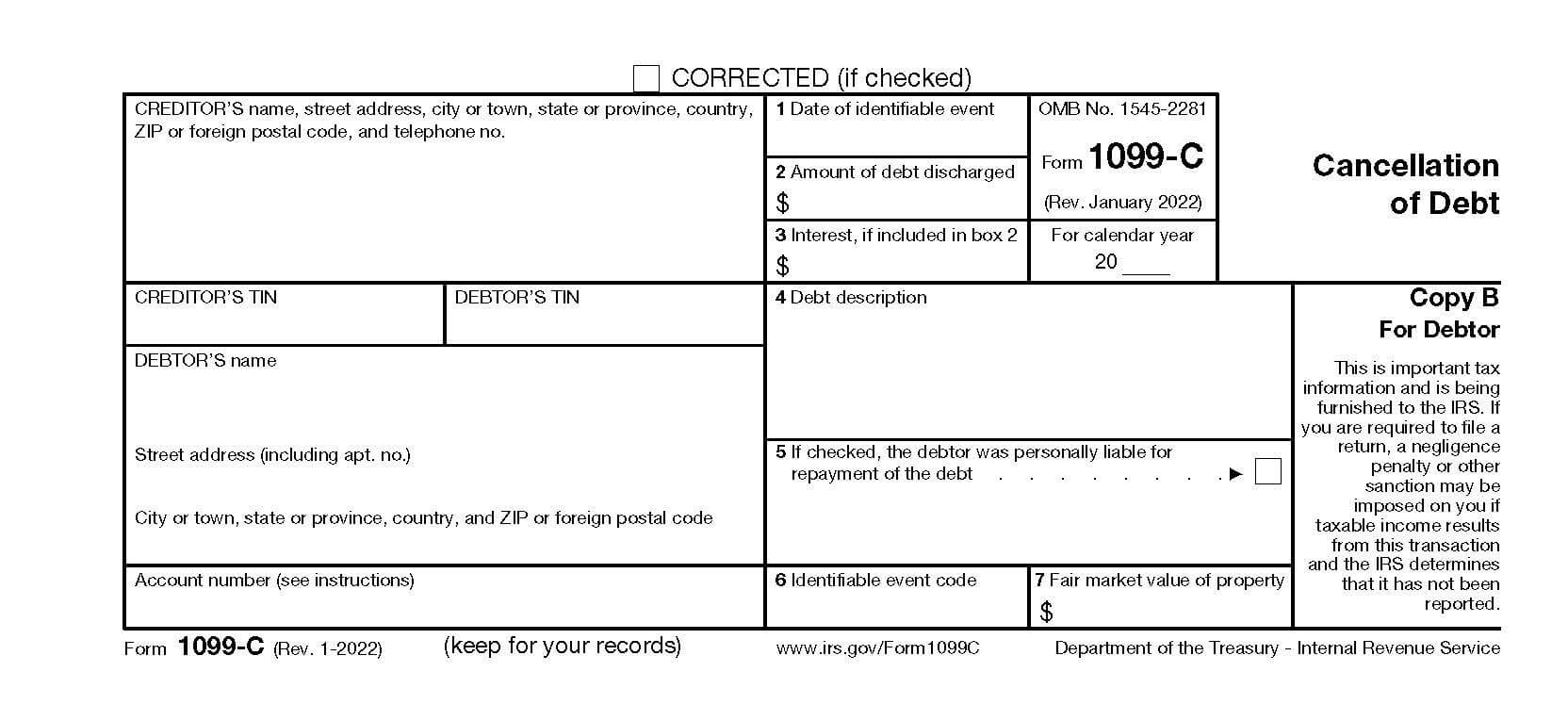

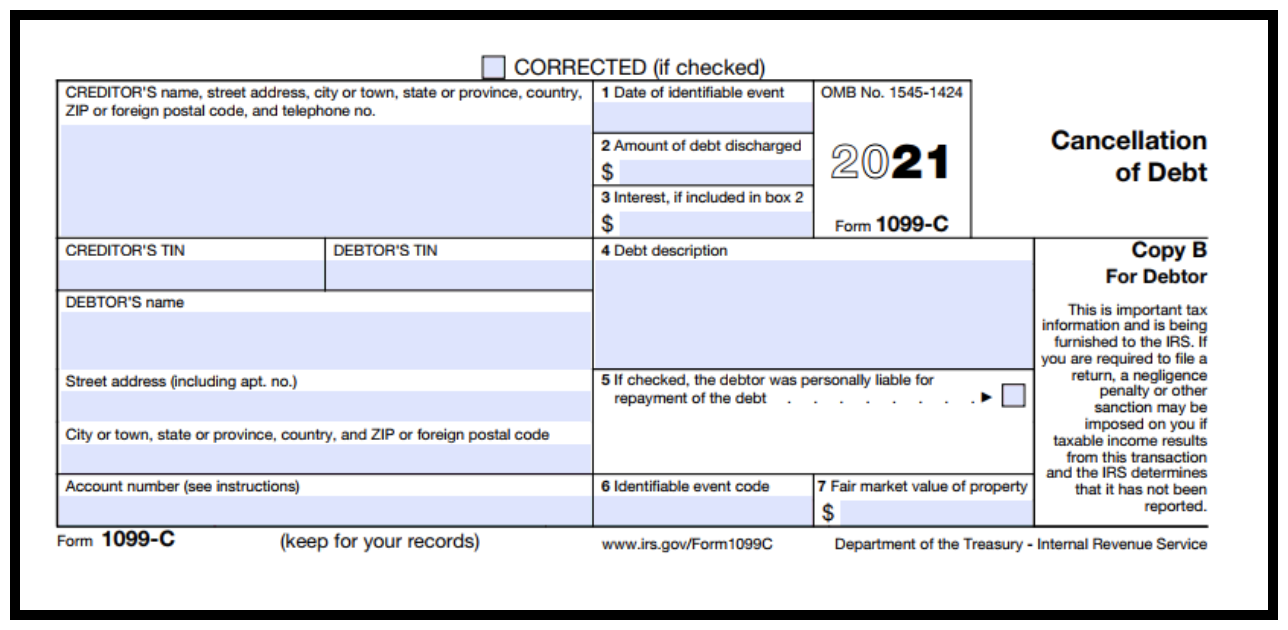

Debt Discharge Letter 1099-C - Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors.

Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors.

Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors.

Who Uses IRS Form 1099C?

Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors.

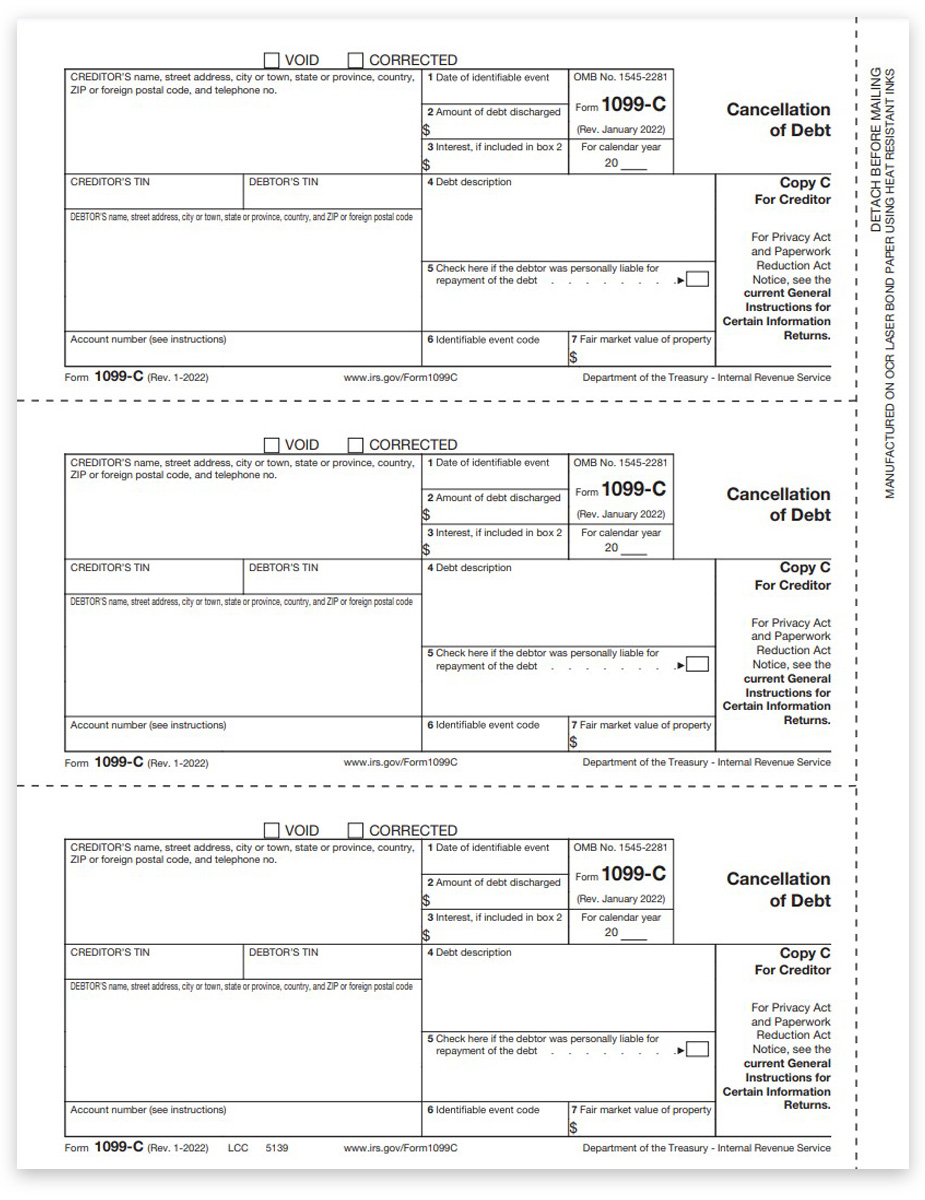

Free IRS 1099C Form PDF eForms

Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors.

How can I pay the taxes for the shown on my 1099C?

Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors.

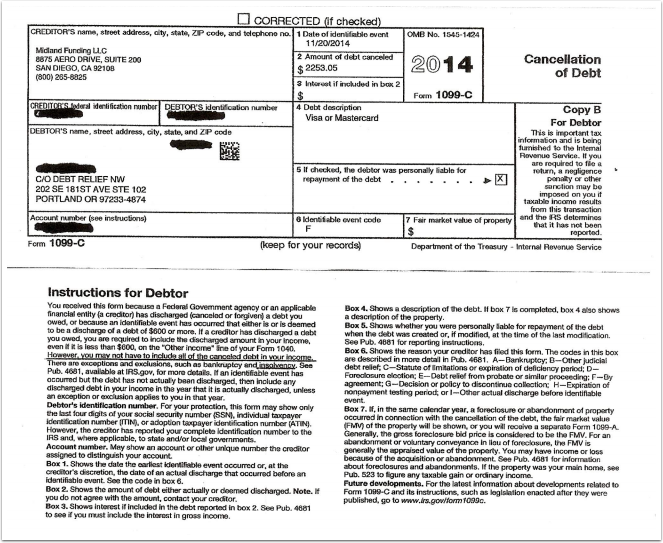

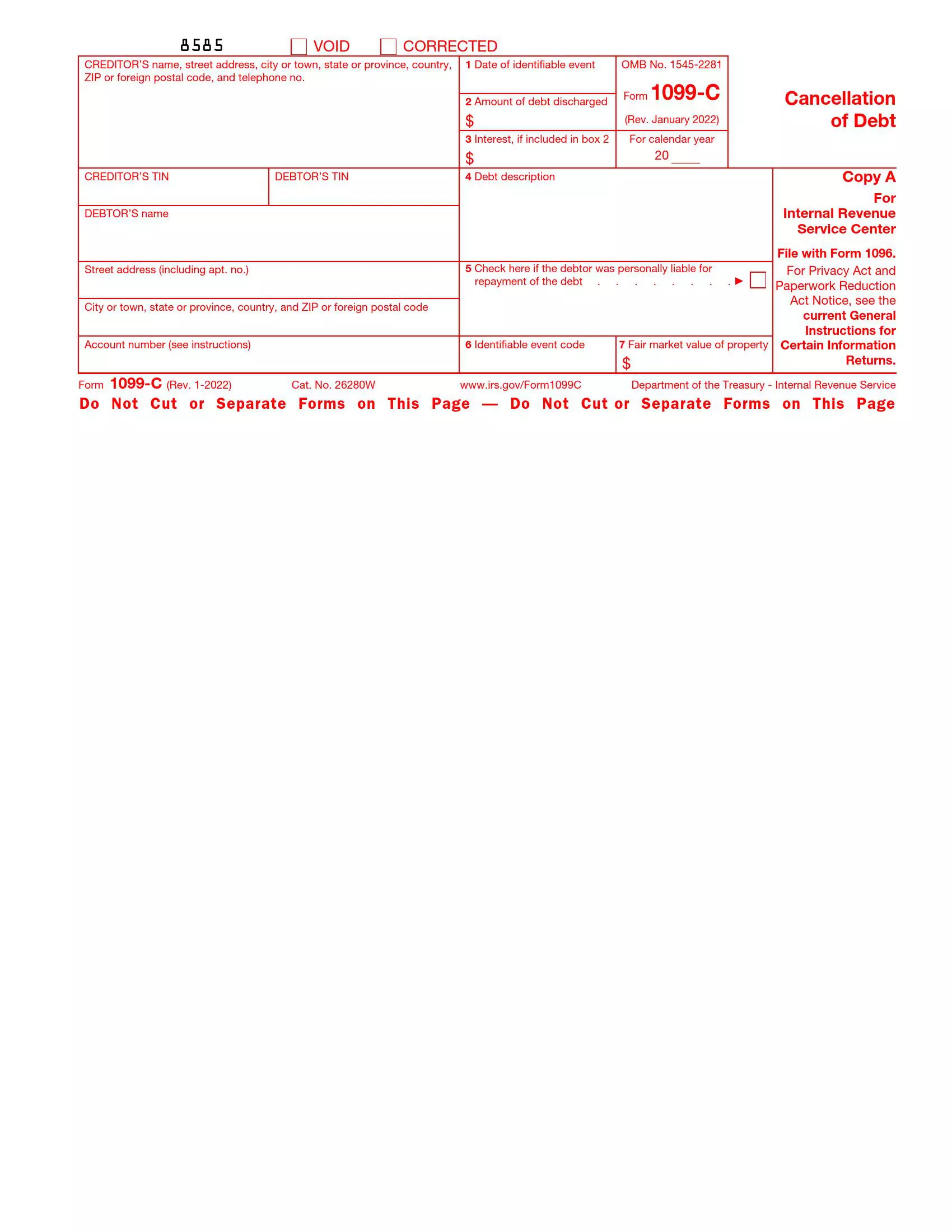

Form 1099C Cancellation of Debt Definition and How to File

Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors.

Form 982 IRS How to Reduce Your Tax Liability Through Debt Discharge?

Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors.

1099C The Surprise Tax Form You Get When You Settle Debt

Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors.

How to Fill Out Form 1099C or Cancellation of Debt PDFRun YouTube

Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors.

What is a 1099C and What to do About it!

Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors.

1099 C Form 2023 Printable Forms Free Online

Cancellation of debt is required by the internal revenue service (irs) to report various payments and transactions made to taxpayers by lenders and creditors.

:max_bytes(150000):strip_icc()/1099-C-69a52b42698048d68609c2c79946530d.jpg)