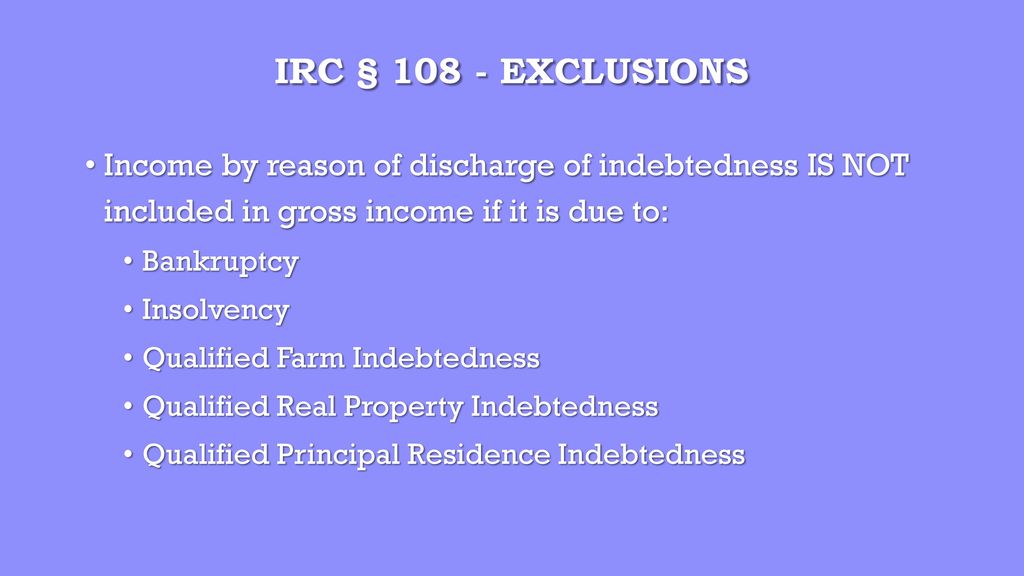

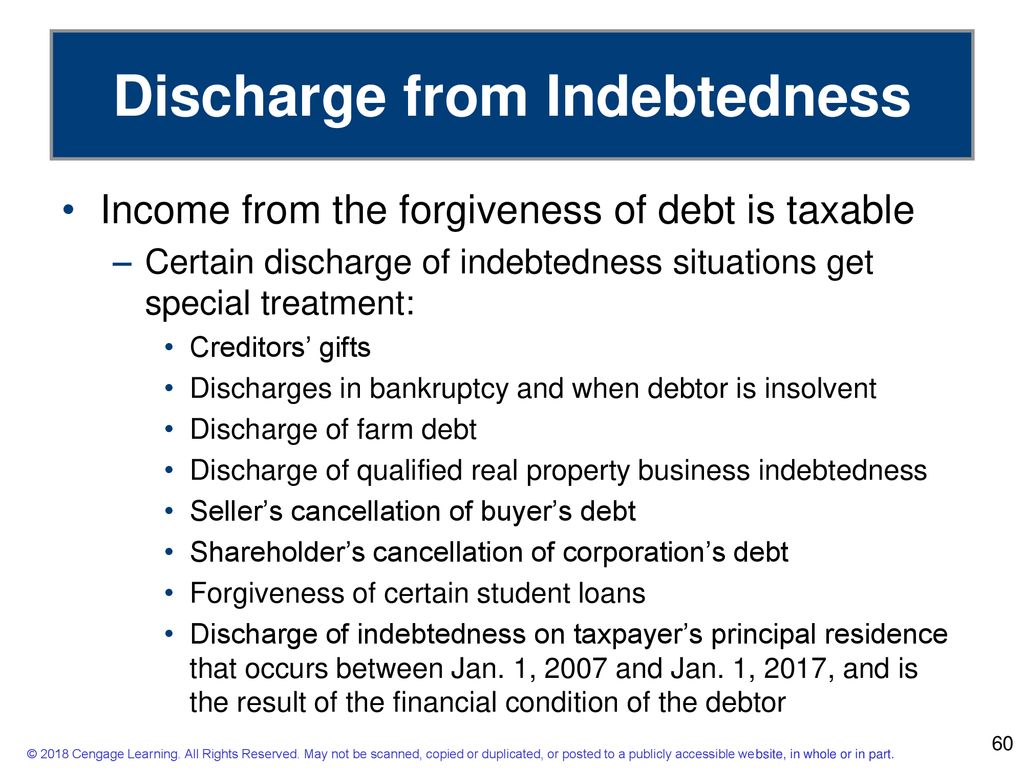

Discharge Of Indebtedness Income - Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the. A discharge of debt income occurs when a debt is forgiven by the person who lend the money. However, there are some instances. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form.

However, there are some instances. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the. A discharge of debt income occurs when a debt is forgiven by the person who lend the money. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form.

Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. However, there are some instances. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. A discharge of debt income occurs when a debt is forgiven by the person who lend the money.

Washington & Lee University School of Law Tax Clinic ppt download

Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the. A discharge of debt income occurs when a debt is forgiven by the person who lend the money. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence.

IRS Form 982 Instructions Discharge of Indebtedness

However, there are some instances. Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. A discharge of debt income occurs when a debt is forgiven by the.

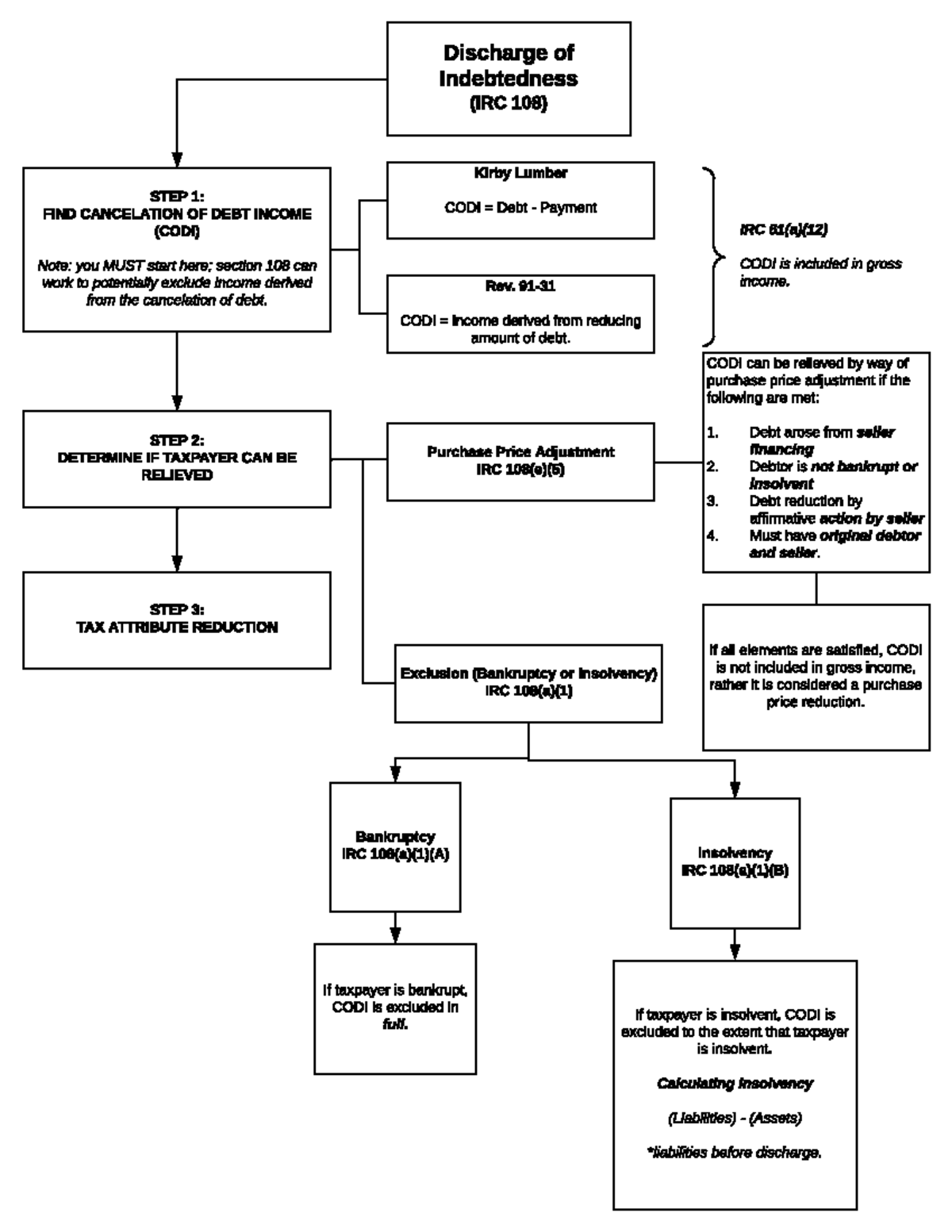

Discharge of Indebtedness Chart 1 Discharge of Indebtedness (IRC

Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. A discharge of debt income occurs when a debt is forgiven by the person who lend the money..

SOLVEDDetermine the amount of that must be recognized in each

To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. A discharge of debt income occurs when a debt is forgiven by the person who lend the.

IRS Form 982 Instructions Discharge of Indebtedness

However, there are some instances. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. A discharge of debt income occurs when a debt is forgiven by.

General Rules of IRC Section 108 From Discharge Of Indebtedness

However, there are some instances. A discharge of debt income occurs when a debt is forgiven by the person who lend the money. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. Gross income does not include any amount which (but for this subsection) would be.

Statement Of From Discharge Of Indebtedness Worksheet

However, there are some instances. A discharge of debt income occurs when a debt is forgiven by the person who lend the money. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Gross income does not include any amount which (but for this subsection) would be includible in gross.

Gross Exclusions ppt download

However, there are some instances. Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the. A discharge of debt income occurs when a debt is forgiven by the person who lend the money. To show that all or part of your canceled debt is excluded from income because.

Discharge of Indebtedness and Student Loan Ambler

However, there are some instances. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. This section explains how to exclude or reduce gross income and tax attributes due to the discharge of certain debts. Gross income does not include any amount which (but for this subsection).

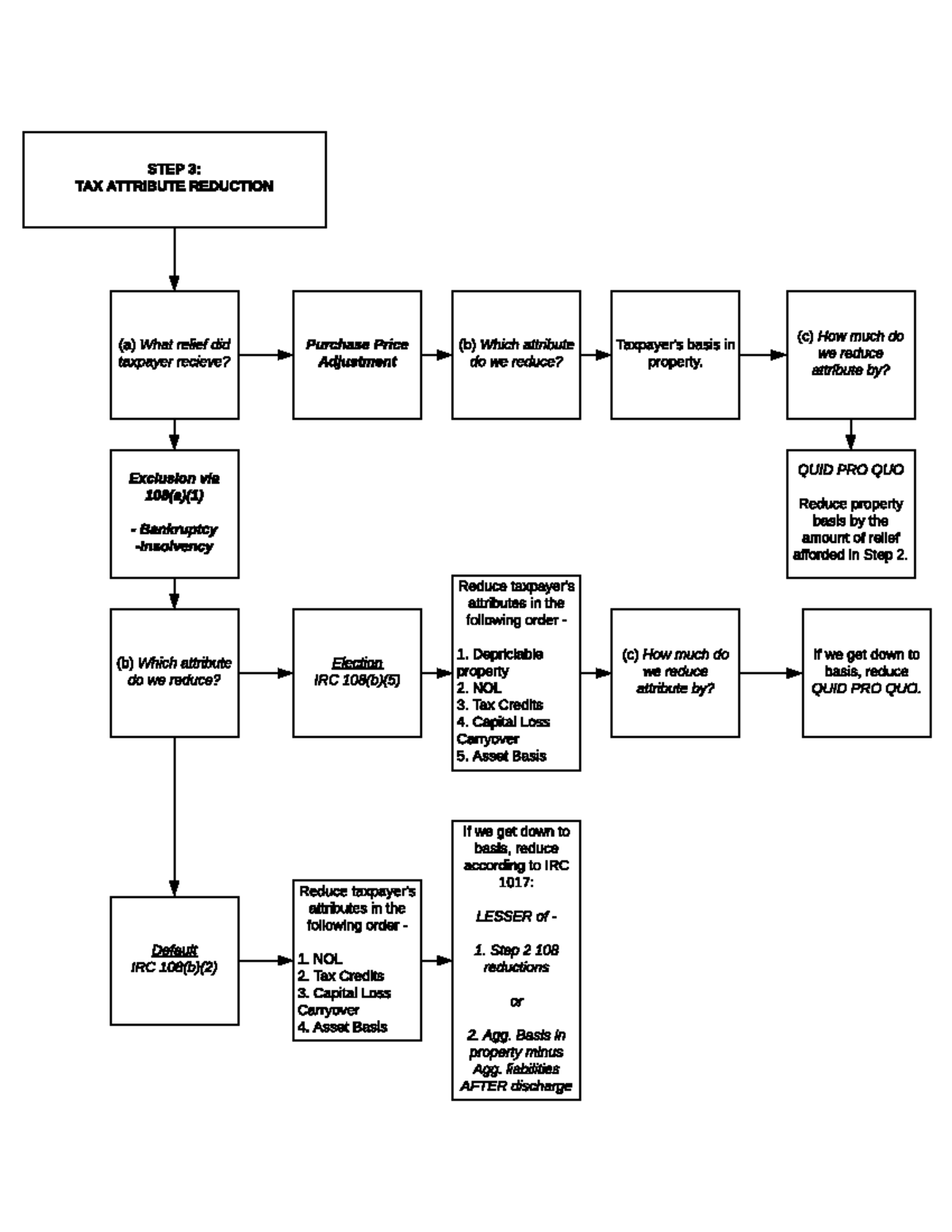

Discharge of Indebtedness Chart 2 STEP 3 TAX ATTRIBUTE REDUCTION

To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. A discharge of debt income occurs when a debt is forgiven by the person who lend the money. However, there are some instances. This section explains how to exclude or reduce gross income and tax attributes due.

This Section Explains How To Exclude Or Reduce Gross Income And Tax Attributes Due To The Discharge Of Certain Debts.

Gross income does not include any amount which (but for this subsection) would be includible in gross income by reason of the. To show that all or part of your canceled debt is excluded from income because it is qualified principal residence indebtedness, attach form. However, there are some instances. A discharge of debt income occurs when a debt is forgiven by the person who lend the money.