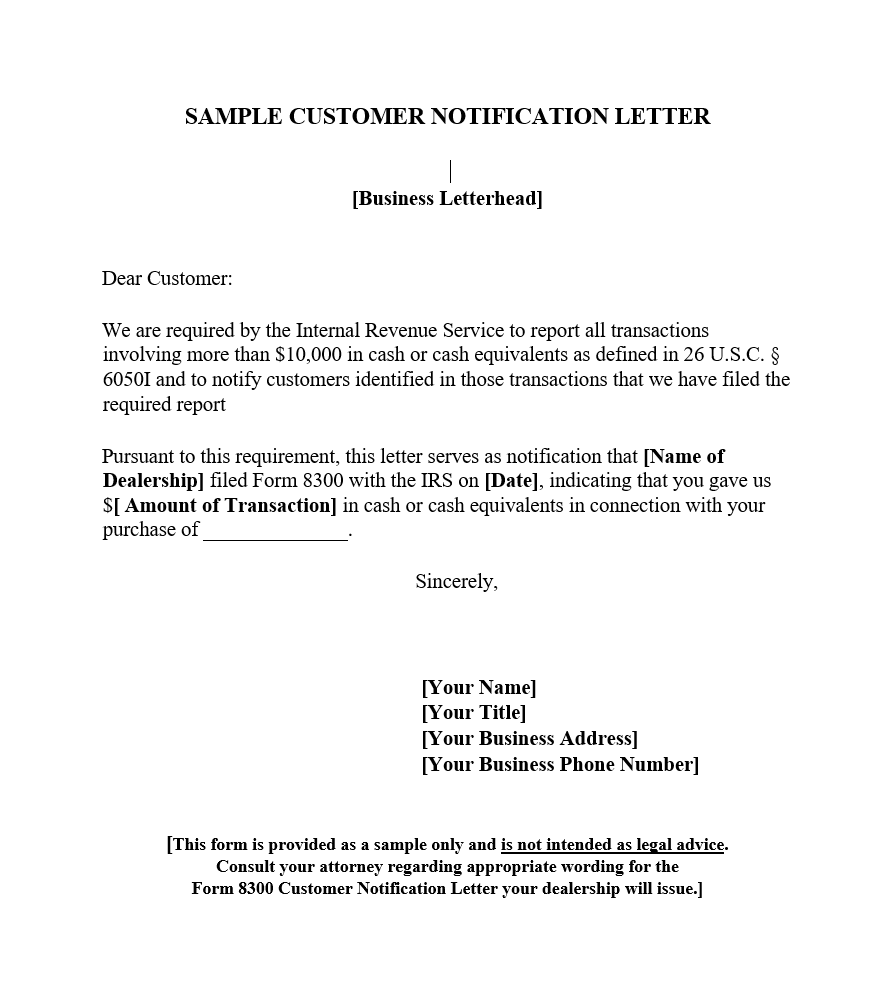

Form 8300 Letter To Customer - The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written. Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you.

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you.

Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written.

Customers > C1 Customer Activity > Customer Processing > Customer

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written. Pursuant to this requirement, this letter serves as notification that.

Sample EForms

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form.

Form 8300 Letter to Customer Letter Draft

Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form.

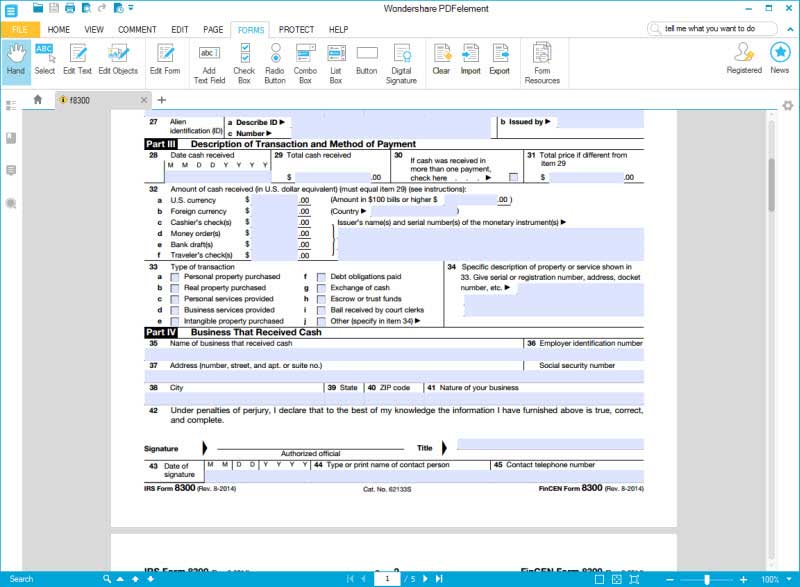

Irs Form 8300 Printable Printable Forms Free Online

Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300.

Customer Notification Letter form 8300 Forms Docs 2023

Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. The business filing form 8300 must provide its identified customers and all parties on the form.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. The business filing form 8300 must provide its identified customers and all parties on the form.

Form 8300 Letter To Customer Sample Letter Hub

Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. The business filing form 8300 must provide its identified customers and all parties on the form that are part of the transaction with the written. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form.

IRS Form 8300 Fill it in a Smart Way

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300.

What Is Form 8300 and How Do You File It? Hourly, Inc.

Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300.

How to Fill in IRS Form 8300 For Cash Payments in a Business YouTube

Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300.

The Business Filing Form 8300 Must Provide Its Identified Customers And All Parties On The Form That Are Part Of The Transaction With The Written.

Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date] , indicating that you. Click here for a sample letter that the dealership can use to notify the customer of the form 8300 reporting. Pursuant to this requirement, this letter serves as notification that [name of dealership] filed form 8300 with the irs on [date], indicating that you.