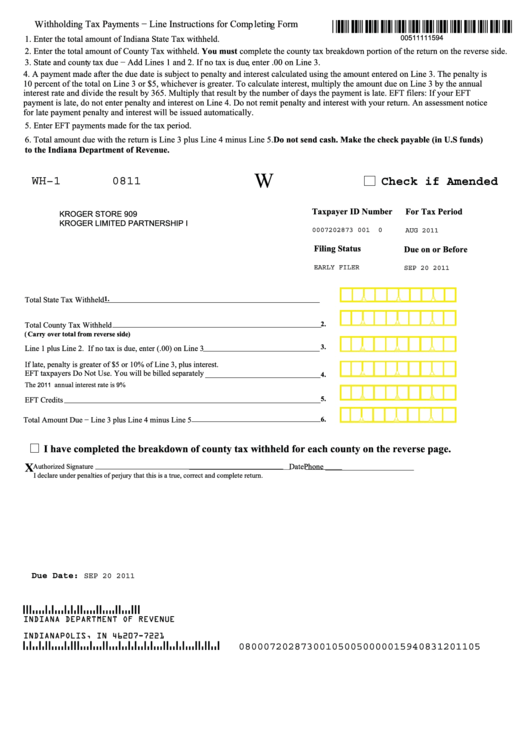

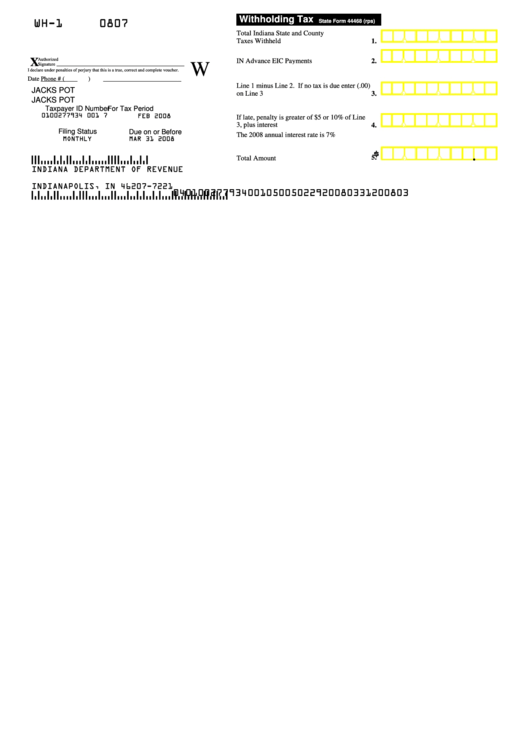

Form Wh 1 - To comply with applicable tax provisions of the internal revenue service(irs) regulations, the information requested on this form is required. *line 1 should include all money withheld for state and county taxes. The purpose of the form is so. Total indiana state and county taxes withheld*. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. This guide covers each section, line by line, of the form.

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. To comply with applicable tax provisions of the internal revenue service(irs) regulations, the information requested on this form is required. Total indiana state and county taxes withheld*. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. This guide covers each section, line by line, of the form. The purpose of the form is so. *line 1 should include all money withheld for state and county taxes.

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. To comply with applicable tax provisions of the internal revenue service(irs) regulations, the information requested on this form is required. The purpose of the form is so. *line 1 should include all money withheld for state and county taxes. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. Total indiana state and county taxes withheld*. This guide covers each section, line by line, of the form.

2020 Form HI UH WH1 Fill Online, Printable, Fillable, Blank pdfFiller

*line 1 should include all money withheld for state and county taxes. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. Total indiana state and county taxes withheld*. The purpose of the form is so. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject.

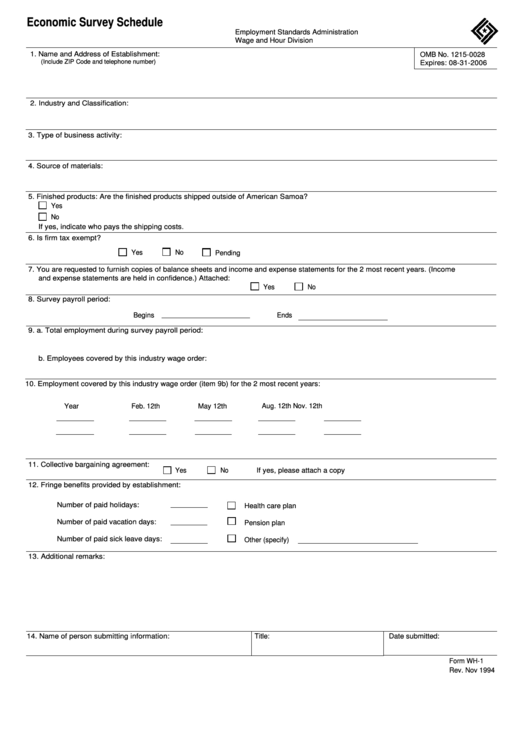

Fillable Form Wh1 Economic Survey Schedule 1994 printable pdf download

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. To comply with applicable tax provisions of the internal revenue service(irs) regulations, the information requested on this form is required. *line 1 should include all money withheld for state and county taxes. The purpose of the form is so. Total indiana state.

Fillable Online cncax Wh 1 Form. Wh 1 Form cncax Fax Email Print

*line 1 should include all money withheld for state and county taxes. To comply with applicable tax provisions of the internal revenue service(irs) regulations, the information requested on this form is required. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. This form should be filed by all withholding agents who.

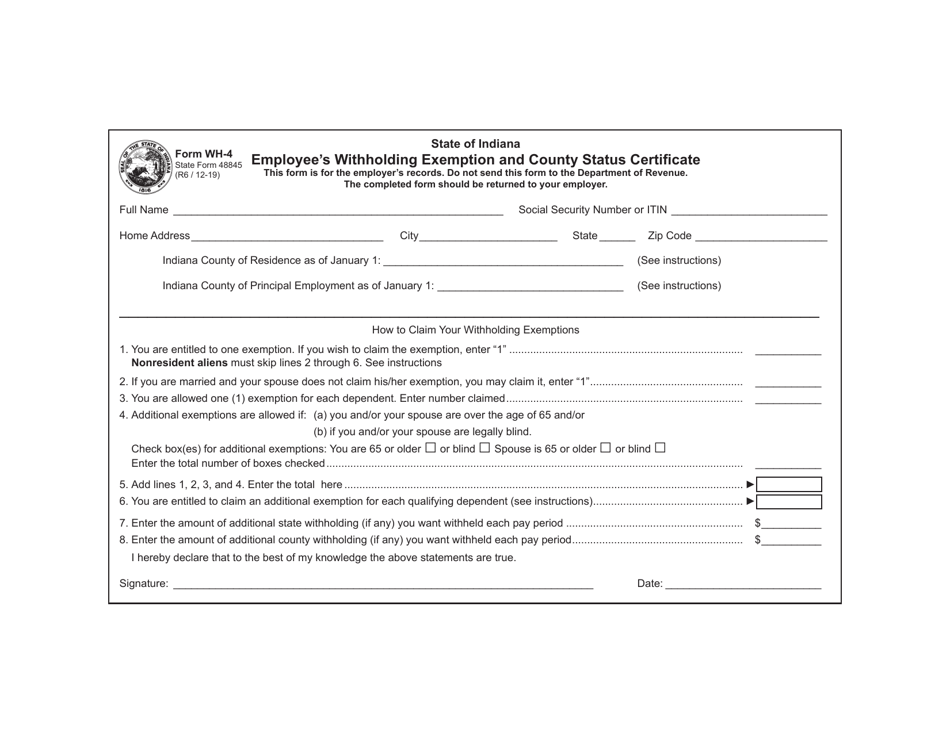

Form WH4 (State Form 48845) Fill Out, Sign Online and Download

*line 1 should include all money withheld for state and county taxes. Total indiana state and county taxes withheld*. The purpose of the form is so. This guide covers each section, line by line, of the form. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,.

Fillable Online UH Form WH1 Fax Email Print pdfFiller

To comply with applicable tax provisions of the internal revenue service(irs) regulations, the information requested on this form is required. The purpose of the form is so. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. This guide covers each section, line by line, of the form. Total indiana state and.

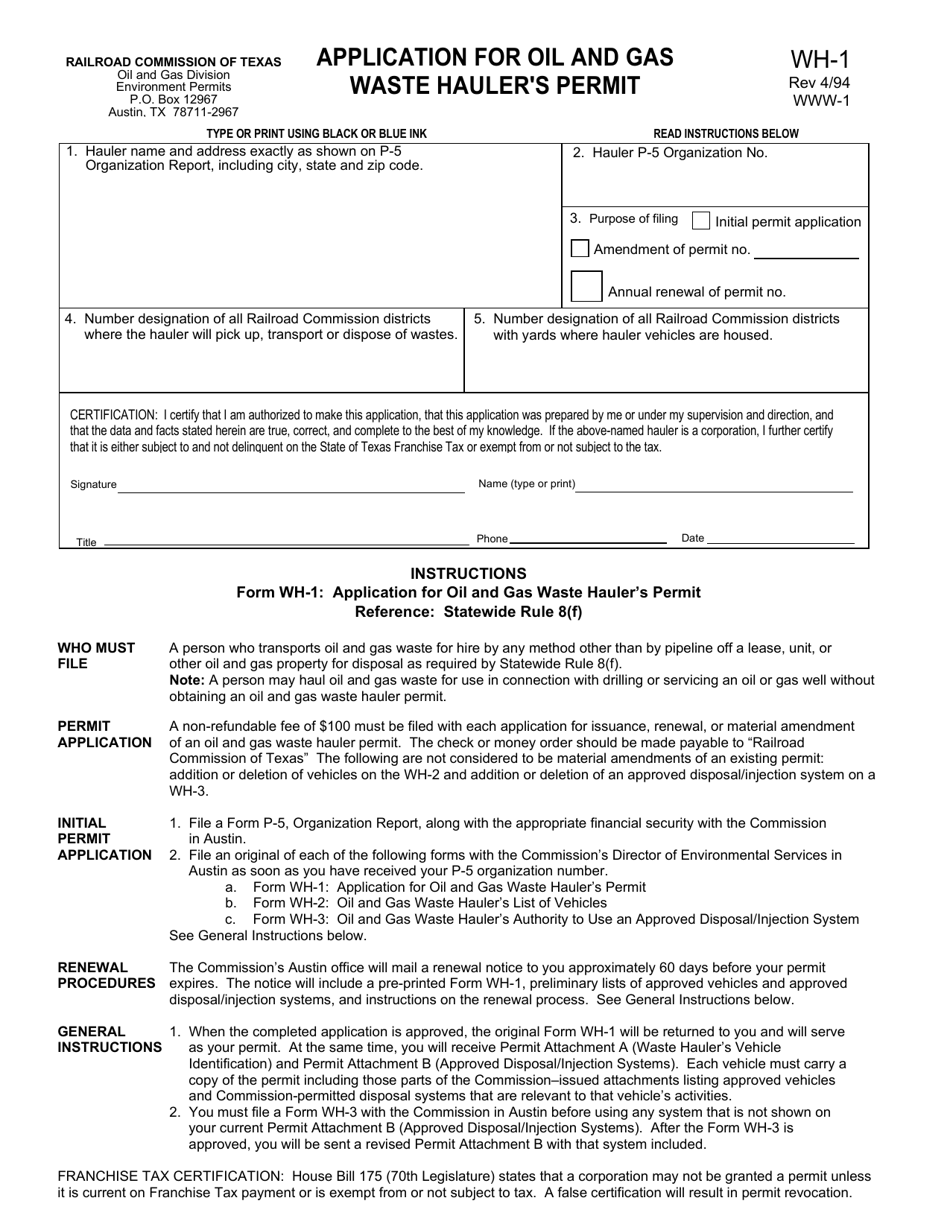

Form WH1 Fill Out, Sign Online and Download Fillable PDF, Texas

Total indiana state and county taxes withheld*. To comply with applicable tax provisions of the internal revenue service(irs) regulations, the information requested on this form is required. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. *line 1 should include all money withheld for state and county taxes. This guide covers.

Form Wh1 Withholding Tax printable pdf download

*line 1 should include all money withheld for state and county taxes. To comply with applicable tax provisions of the internal revenue service(irs) regulations, the information requested on this form is required. Total indiana state and county taxes withheld*. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. This form should.

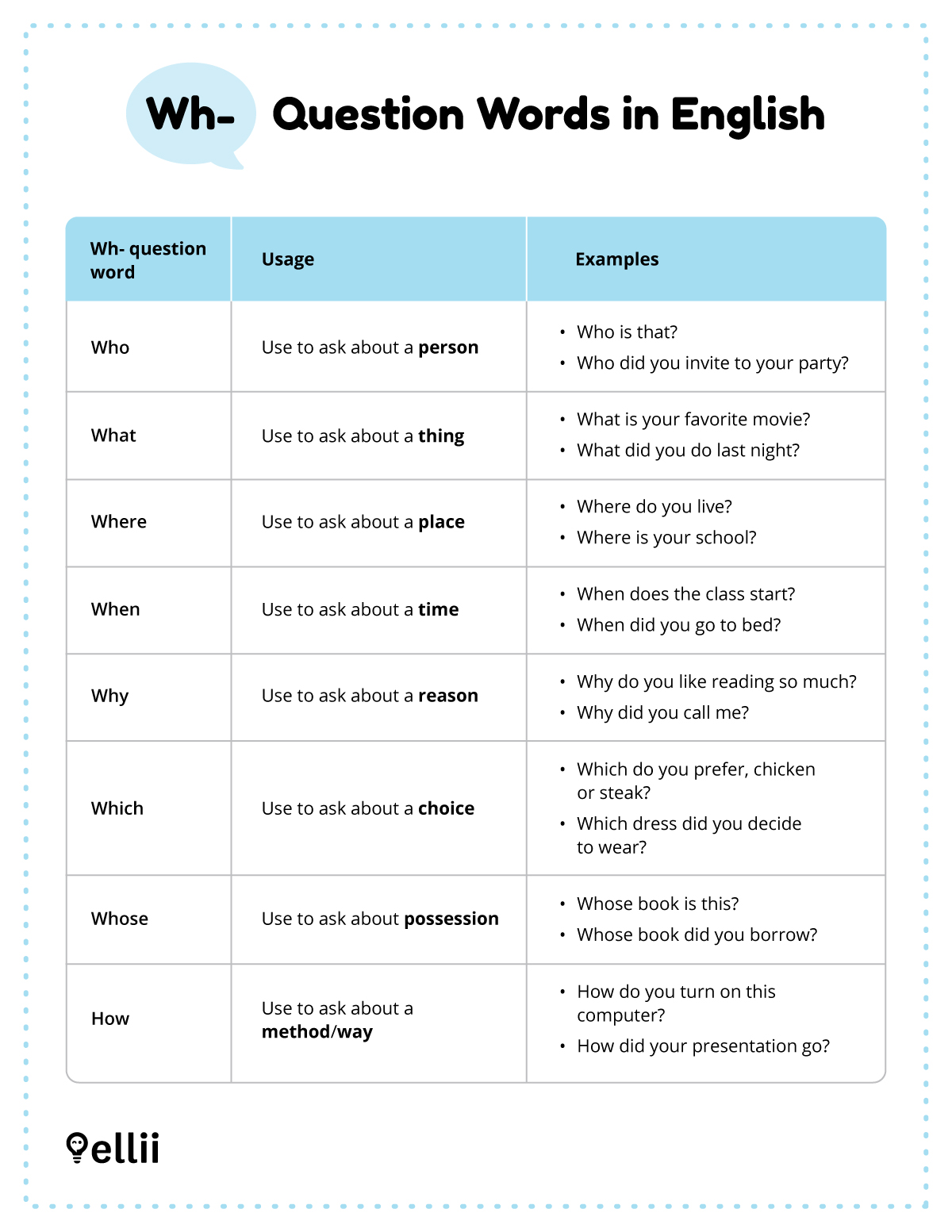

What Are Wh Questions in English? Ellii Blog

Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. *line 1 should include all money withheld for state and county taxes. This guide covers each section, line by line, of the form. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. Total.

Form Wh1 Withholding Tax printable pdf download

This guide covers each section, line by line, of the form. *line 1 should include all money withheld for state and county taxes. The purpose of the form is so. Total indiana state and county taxes withheld*. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,.

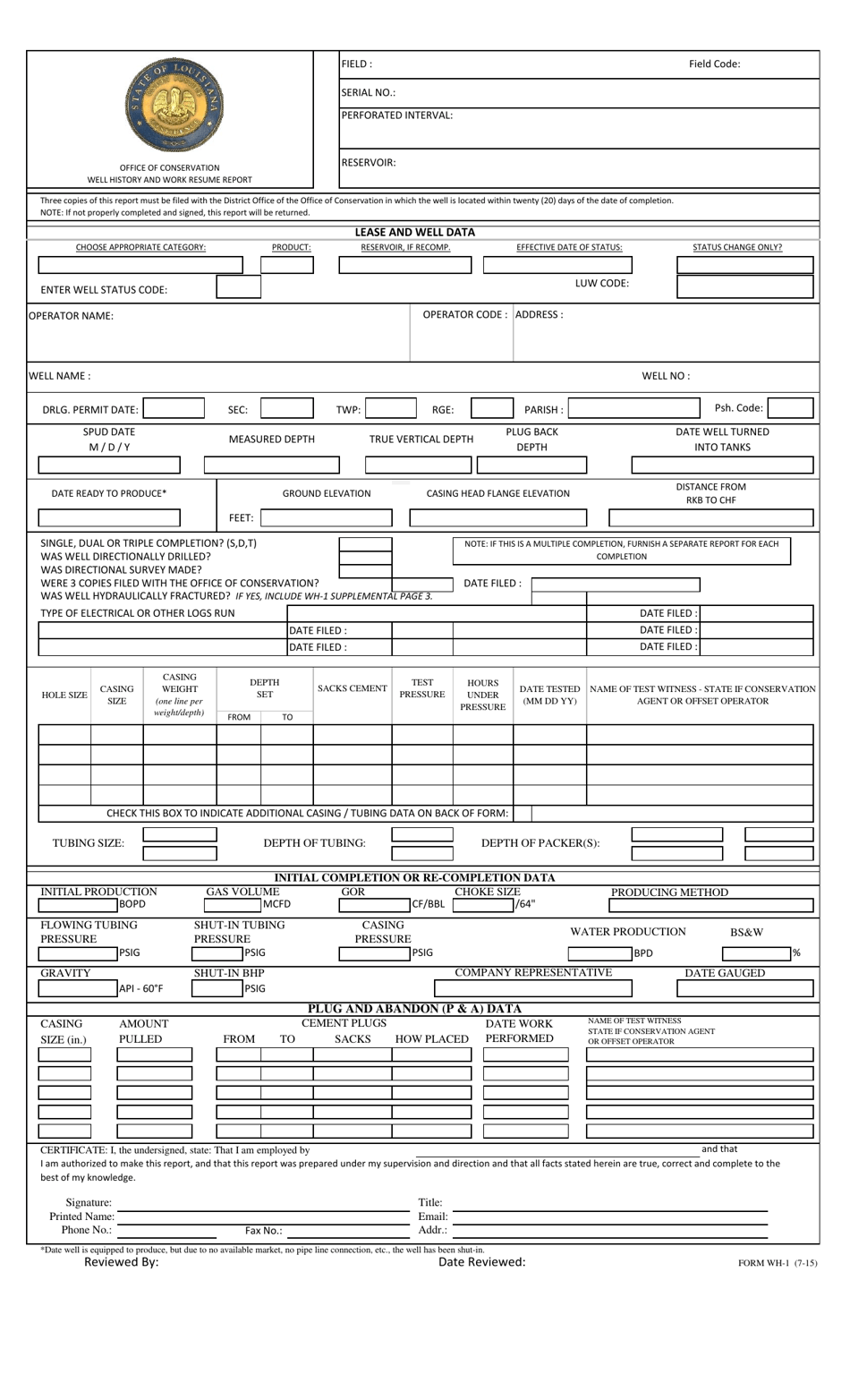

Form WH1 Fill Out, Sign Online and Download Printable PDF, Louisiana

The purpose of the form is so. This form should be filed by all withholding agents who withhold state and/or county income tax from employees,. This guide covers each section, line by line, of the form. *line 1 should include all money withheld for state and county taxes. Employers who are making payments of salaries, wages, tips, fees, bonuses, and.

This Guide Covers Each Section, Line By Line, Of The Form.

Total indiana state and county taxes withheld*. Employers who are making payments of salaries, wages, tips, fees, bonuses, and commissions that are subject to indiana. To comply with applicable tax provisions of the internal revenue service(irs) regulations, the information requested on this form is required. The purpose of the form is so.

This Form Should Be Filed By All Withholding Agents Who Withhold State And/Or County Income Tax From Employees,.

*line 1 should include all money withheld for state and county taxes.