Home Loan Discharge - Selling your property (sale) repaying your home loan in full (payout) refinancing your. If you’re discharging to sell a property, substitute a security (property or cash), release a guarantor. Ready to discharge your home loan? Are you a home loan customer? If you’re selling your home, paying out your loan and closing it, or releasing the security, you can. If you’re selling your property, paying off your home loan in full, or refinancing your home loan, you’ll need to complete a mortgage release or. There are three main reasons to discharge your home loan: There are various reasons for requesting a discharge, these include selling, refinancing, loan repaid, and substitution of a security or.

Selling your property (sale) repaying your home loan in full (payout) refinancing your. If you’re discharging to sell a property, substitute a security (property or cash), release a guarantor. Are you a home loan customer? There are various reasons for requesting a discharge, these include selling, refinancing, loan repaid, and substitution of a security or. If you’re selling your home, paying out your loan and closing it, or releasing the security, you can. Ready to discharge your home loan? There are three main reasons to discharge your home loan: If you’re selling your property, paying off your home loan in full, or refinancing your home loan, you’ll need to complete a mortgage release or.

There are three main reasons to discharge your home loan: If you’re discharging to sell a property, substitute a security (property or cash), release a guarantor. If you’re selling your property, paying off your home loan in full, or refinancing your home loan, you’ll need to complete a mortgage release or. There are various reasons for requesting a discharge, these include selling, refinancing, loan repaid, and substitution of a security or. If you’re selling your home, paying out your loan and closing it, or releasing the security, you can. Are you a home loan customer? Selling your property (sale) repaying your home loan in full (payout) refinancing your. Ready to discharge your home loan?

Should I refinance my home loan? BankSA

If you’re selling your home, paying out your loan and closing it, or releasing the security, you can. There are three main reasons to discharge your home loan: Ready to discharge your home loan? If you’re selling your property, paying off your home loan in full, or refinancing your home loan, you’ll need to complete a mortgage release or. If.

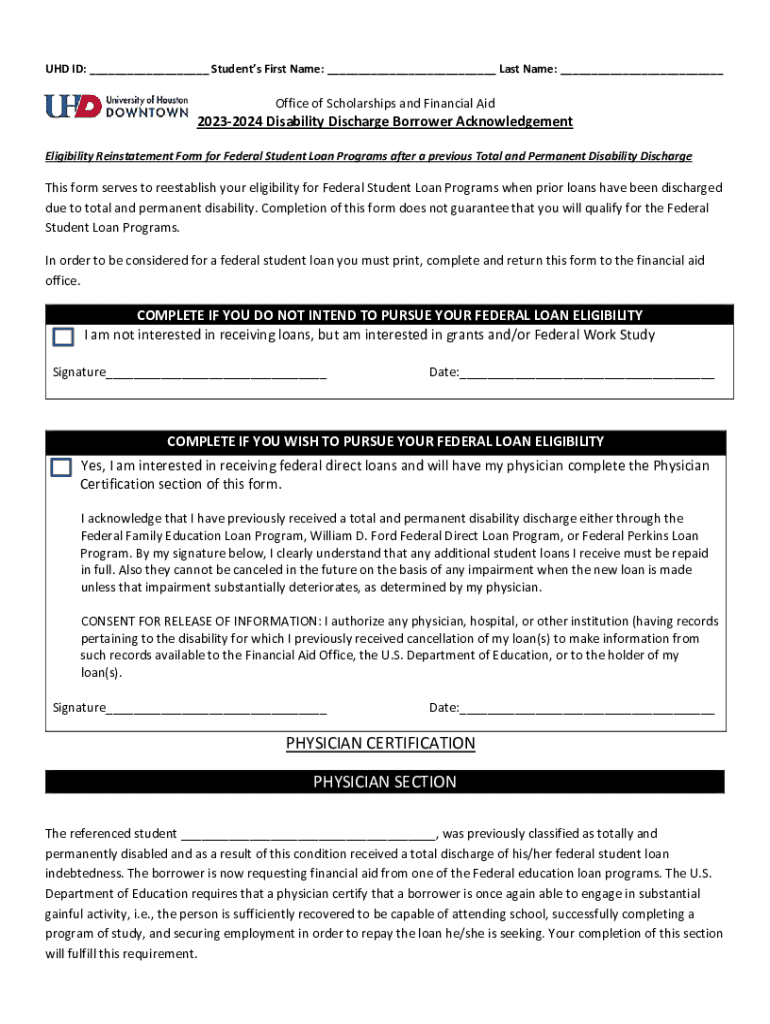

Fillable Online borrowers acknowledgement loan discharge form Fax

If you’re selling your home, paying out your loan and closing it, or releasing the security, you can. Ready to discharge your home loan? Selling your property (sale) repaying your home loan in full (payout) refinancing your. There are various reasons for requesting a discharge, these include selling, refinancing, loan repaid, and substitution of a security or. There are three.

Discharge of Mortgage What to Expect NerdWallet Australia

If you’re discharging to sell a property, substitute a security (property or cash), release a guarantor. There are three main reasons to discharge your home loan: Selling your property (sale) repaying your home loan in full (payout) refinancing your. If you’re selling your property, paying off your home loan in full, or refinancing your home loan, you’ll need to complete.

Sample Discharge of Mortgage New Jersey Free Download

There are three main reasons to discharge your home loan: If you’re selling your home, paying out your loan and closing it, or releasing the security, you can. If you’re discharging to sell a property, substitute a security (property or cash), release a guarantor. If you’re selling your property, paying off your home loan in full, or refinancing your home.

AU Sintex Loan Discharge Authority Form Fill and Sign Printable

If you’re selling your property, paying off your home loan in full, or refinancing your home loan, you’ll need to complete a mortgage release or. Are you a home loan customer? If you’re selling your home, paying out your loan and closing it, or releasing the security, you can. Selling your property (sale) repaying your home loan in full (payout).

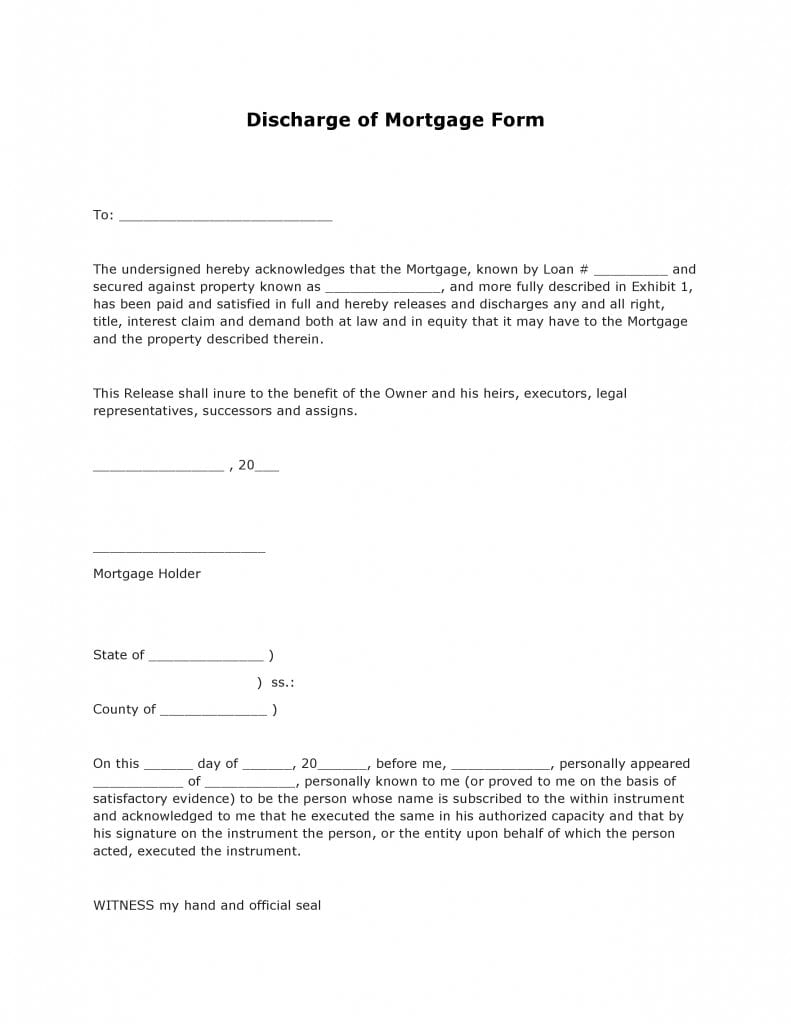

Discharge of Mortgage

Selling your property (sale) repaying your home loan in full (payout) refinancing your. Are you a home loan customer? There are various reasons for requesting a discharge, these include selling, refinancing, loan repaid, and substitution of a security or. If you’re discharging to sell a property, substitute a security (property or cash), release a guarantor. If you’re selling your home,.

MFAA proposes streamlined home loan discharge process Mortgage

There are three main reasons to discharge your home loan: Selling your property (sale) repaying your home loan in full (payout) refinancing your. Are you a home loan customer? If you’re selling your property, paying off your home loan in full, or refinancing your home loan, you’ll need to complete a mortgage release or. If you’re discharging to sell a.

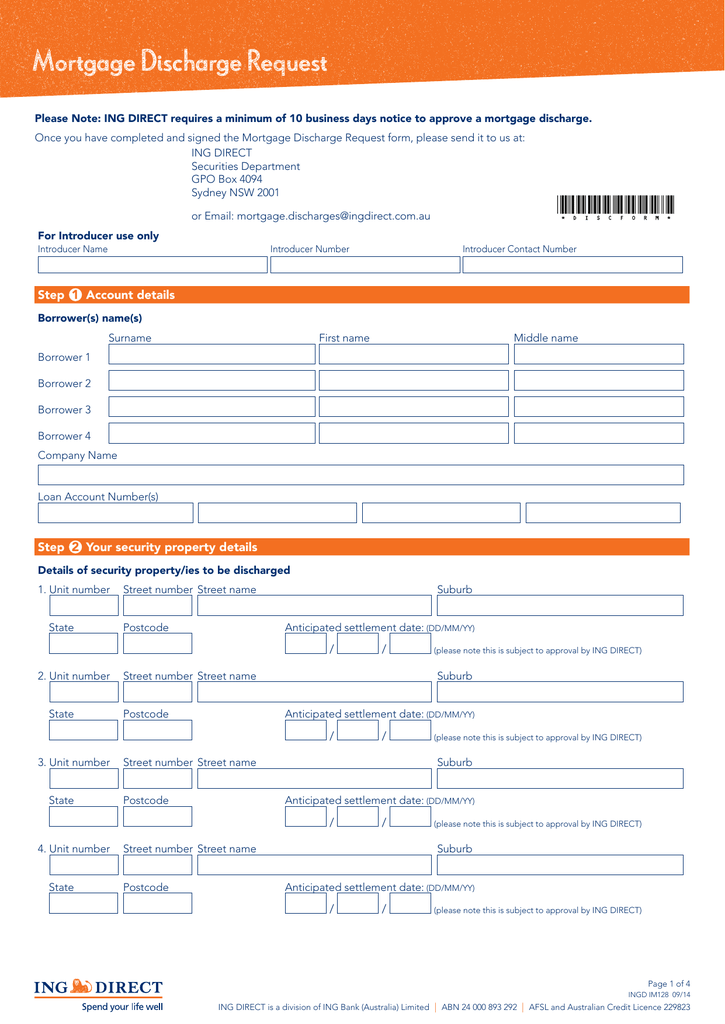

Mortgage Discharge Request

If you’re selling your home, paying out your loan and closing it, or releasing the security, you can. Are you a home loan customer? Selling your property (sale) repaying your home loan in full (payout) refinancing your. There are various reasons for requesting a discharge, these include selling, refinancing, loan repaid, and substitution of a security or. If you’re selling.

Can a bankruptcy discharge a second mortgage or home equity loan? YouTube

If you’re discharging to sell a property, substitute a security (property or cash), release a guarantor. Selling your property (sale) repaying your home loan in full (payout) refinancing your. If you’re selling your home, paying out your loan and closing it, or releasing the security, you can. There are various reasons for requesting a discharge, these include selling, refinancing, loan.

Free Discharge of Mortgage Form PDF Template Form Download

Ready to discharge your home loan? If you’re discharging to sell a property, substitute a security (property or cash), release a guarantor. There are three main reasons to discharge your home loan: There are various reasons for requesting a discharge, these include selling, refinancing, loan repaid, and substitution of a security or. Selling your property (sale) repaying your home loan.

If You’re Selling Your Home, Paying Out Your Loan And Closing It, Or Releasing The Security, You Can.

There are various reasons for requesting a discharge, these include selling, refinancing, loan repaid, and substitution of a security or. If you’re selling your property, paying off your home loan in full, or refinancing your home loan, you’ll need to complete a mortgage release or. There are three main reasons to discharge your home loan: Selling your property (sale) repaying your home loan in full (payout) refinancing your.

Ready To Discharge Your Home Loan?

If you’re discharging to sell a property, substitute a security (property or cash), release a guarantor. Are you a home loan customer?